November '22 Chat -- A gravy train? A gravy boat? Its ALL gravy!!!!

- Thread starter TheBac

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

oh come on now...There ya go!

Parts are secret until I figure out if they'll actually work.

You know what's funny, I have some strange NOS stuff my self.

probably wheel spinnersDo tell ! what did you find???

I have been wanting an LBZ but I am not paying 30-40K for one that is in the same shape as my LLY... So I did the next best thing. Bought a wrecked doner truck... LOL

Thats not what the Email alert said...probably wheel spinners

real question is he wanted it for 16 years.... How long till he see's if it will work or not....

white new balance high top shoes to wear in the vette?

In on this

Mortgage rates are shit. Things are slowing down drastically around here. Glad we got in ours when we did.

Mortgage rates are shit. Things are slowing down drastically around here. Glad we got in ours when we did.

I got in on mine when it got down to $150k. now it's up around $375k or more. so if I ever did want to sell it , it should at least keep me from going upside down on it. and I'm in California so prices rarely go down but often go up.In on this

Mortgage rates are shit. Things are slowing down drastically around here. Glad we got in ours when we did.

if I was to sell today I should be able to net at least $250k in my pocket after paying the bank back and before California steels half of it

What are the capital gains laws in Cali? I THINK here in Nevada you can make up to $250k if you file single and 500k if joint before they take capital gains. And unlimited if you use the money to buy a new house within a certain amount of time.

I'm not well versed in the California law regarding it but I don't think there is any upper or lower limits. I believe if you don't use it to purchase your primary home within two years (was one year not too long ago) they will take something like 30%. and if anything is leftover they will tax that. I've also heard of them going after you if you sell and take the money out of state.

I think there is probably more that they will try and get but not sure on the details. I think they tax it several ways. capital gains and income, maybe more

I think there is probably more that they will try and get but not sure on the details. I think they tax it several ways. capital gains and income, maybe more

I'm 3 to 5 years out from retirement. Last house had been paid for, for quite a while. We pulled a construction loan in the fall of 2021 to build the new house and shop. Reason being we were able to lock in a rate in the fall of 21, that is lower enough where theoretically our investments should return at a higher rate.

Obviously, for the last 8 to 10 months that has not been the case. The dumpster fire of an economy we have now is well documented, but suffice it to say, I've lost a lot. I do believe it's going to turn around in the next 4 to 6 months, but who knows.

Point of the whole sad story is I agree with James, I will carry the mortgage and use the banks money, hopefully at a lower rate than my investments are performing.

Just my two cents.

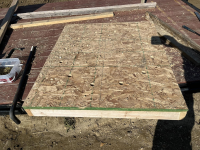

And just because we all like pictures, yesterday I finished up the wet set template for the jib crane base bolts. If we ever get mud (who knew there would be a cement shortage) we can set them. Once the mud hardens, pull the wood template and set the crane.

Obviously, for the last 8 to 10 months that has not been the case. The dumpster fire of an economy we have now is well documented, but suffice it to say, I've lost a lot. I do believe it's going to turn around in the next 4 to 6 months, but who knows.

Point of the whole sad story is I agree with James, I will carry the mortgage and use the banks money, hopefully at a lower rate than my investments are performing.

Just my two cents.

And just because we all like pictures, yesterday I finished up the wet set template for the jib crane base bolts. If we ever get mud (who knew there would be a cement shortage) we can set them. Once the mud hardens, pull the wood template and set the crane.

Where are you guys out of? the cement shortage finally caught back up here about 2 months ago.I'm 3 to 5 years out from retirement. Last house had been paid for, for quite a while. We pulled a construction loan in the fall of 2021 to build the new house and shop. Reason being we were able to lock in a rate in the fall of 21, that is lower enough where theoretically our investments should return at a higher rate.

Obviously, for the last 8 to 10 months that has not been the case. The dumpster fire of an economy we have now is well documented, but suffice it to say, I've lost a lot. I do believe it's going to turn around in the next 4 to 6 months, but who knows.

Point of the whole sad story is I agree with James, I will carry the mortgage and use the banks money, hopefully at a lower rate than my investments are performing.

Just my two cents.

And just because we all like pictures, yesterday I finished up the wet set template for the jib crane base bolts. If we ever get mud (who knew there would be a cement shortage) we can set them. Once the mud hardens, pull the wood template and set the crane.

View attachment 110816

View attachment 110817

View attachment 110818

View attachment 110819

I'm not well versed in the California law regarding it but I don't think there is any upper or lower limits. I believe if you don't use it to purchase your primary home within two years (was one year not too long ago) they will take something like 30%. and if anything is leftover they will tax that. I've also heard of them going after you if you sell and take the money out of state.

I think there is probably more that they will try and get but not sure on the details. I think they tax it several ways. capital gains and income, maybe more

Sitting on that much money in your savings is not doing you any favors. You're basically losing money every month. My financial adviser recommends me have 6 months in savings. I don't do that because I will do whatever I have to do to earn money. And I live in a place where I always have options.

One thing I haven't heard anyone mentioned is inflation. I would probably run it through my financial adviser, but I would probably be leaning toward paying off my mortgage in a lump sum right now with inflation like it is. I also have a huge issue with loans and paying interest though. For example I found a mortgage that would allow me to buy my interest rate down. Don't bother searching I don't think they exist anymore. It cost me $30,000 up front but I bought my interest rate down all the way to 0.25%. No that's not a typo. I will never make any sort of extra payment toward my mortgage.

Lastly lasting I would worry about is ever losing your house. Banks are pretty forgiving. They just about want to not foreclose on your house less than you would want them to. Guaranteed they're gonna lose money most of the time. Financial advisers advise when you get hard up for money the mortgage is the last thing you pay. But you do have a discussion with them about your situation to try and buy time.

One of my buddies who is an idiot when it comes to finances. Took advantage of his bank being very understanding during covid. He didn't make a payment on his mortgage for over a year. In that year he bought a Dodge demon and a Ram TRX. And spent tens of thousands of dollars on modding them.

Last edited:

Im not sure im following you on this. how are you tieing inflation to the mortgage? are you thinking this as if you were refi, selling or buying? or as if hes in the house for the long run and keeping things as is?One thing I haven't heard anyone mentioned is inflation. I would probably run it through my financial adviser, but I would probably be leaning toward paying off my mortgage in a lump sum right now with inflation like it is. I also have a huge issue with loans and paying interest though. For example I found a mortgage that would allow me to buy my interest rate down. Don't bother searching I don't think they exist anymore. It cost me $30,000 up front but I bought my interest rate down all the way to 0.25%. No that's not a typo. I will never make any sort of extra payment toward my mortgage.

Yeah I didn't explain that the best. With 8% inflation any investments with less then 8% return you are losing money on. So spend it. Especially paying off things that your paying interest on.Im not sure im following you on this. how are you tieing inflation to the mortgage? are you thinking this as if you were refi, selling or buying? or as if hes in the house for the long run and keeping things as is?

this is what I was trying to get at but may not have explained it well. the money is reducing in value as it sits but it's the same value as my house payment as it doesn't change. so if I use the savings to pay it off then at least I'm not loosing it's value anymore.Yeah I didn't explain that the best. With 8% inflation any investments with less then 8% return you are losing money on. So spend it. Especially paying off things that your paying interest on.

right now I don't think there is any investments (at least not available to me) that can keep up with inflation so as to keep the savings from loosing value. but if I can avoid paying for the remaining interest on the house then that should be like making or saving upto $64k.

the only thing would be having less money for a number of years to fall back on or invest with. if the market turns around in a few years it would be nice to have a good chunk to invest with. but will it make the same or more then what I can save in mortgage interest in the same timeframe

I don't know how it works where he's at but here the suspension of payment on the mortgage just put it on the back end and extended the terms. so no saving anything. and I will not extend my mortgage terms and keep me in debt for longer then necessaryOne of my buddies who is an idiot when it comes to finances. Took advantage of his bank being very understanding during covid. He didn't make a payment on his mortgage for over a year. In that year he bought a Dodge demon and a Ram TRX. And spent tens of thousands of dollars on modding them.

the only thing would be having less money for a number of years to fall back on or invest with. if the market turns around in a few years it would be nice to have a good chunk to invest with. but will it make the same or more then what I can save in mortgage interest in the same timeframe

I feel like a guaranteed $64,000 savings by paying off your mortgage is a pretty good investment. Better than anything you're gonna do anytime soon. Other then playing high risk and high reward in the market. Thats the only way I see you making that kind of money. I'm not sure how accurate this is but I kind of picture it as inflation is 8.3%. You're mortgage is 4%+. Just a break even your investments need to be maken you 13%.

Ya that how it works as far as I understand. I was more talking about that a option if you lose your job.I don't know how it works where he's at but here the suspension of payment on the mortgage just put it on the back end and extended the terms. so no saving anything. and I will not extend my mortgage terms and keep me in debt for longer then necessary

All that is looking at the short term though. i can see doing that if you plan to retire, where inflation and fixed income and pulling from investments is something you have to live off of.

right now, you have plenty of time to "let it ride". your rate of pay has not changed, your house payment has not changed, your savings has not changed. cost of living may have gone up but your investments are not paying for that. your investments have changed but they wont be stuck there, they will come back. people would not invest in the stock market if there was not some kind of return made from it, the issue is its going to be long term to see it when done correctly. you cant look at the short term imho because it really has no effect on you. on average, the market is 10% earnings over 15-20 year span.

imho, right now is the time to buy stocks. buy low, sell high.

How have your investments trended over the last 5-10 years? 20 years? look at this trend and see how its been doing in the long run.

right now, you have plenty of time to "let it ride". your rate of pay has not changed, your house payment has not changed, your savings has not changed. cost of living may have gone up but your investments are not paying for that. your investments have changed but they wont be stuck there, they will come back. people would not invest in the stock market if there was not some kind of return made from it, the issue is its going to be long term to see it when done correctly. you cant look at the short term imho because it really has no effect on you. on average, the market is 10% earnings over 15-20 year span.

imho, right now is the time to buy stocks. buy low, sell high.

How have your investments trended over the last 5-10 years? 20 years? look at this trend and see how its been doing in the long run.

what I like about this is it is guaranteed. if I take that same $94k that I would use to pay off mortgage then I would need an average of 5.2% interest over the 11 years to make the same $64k. but I would need to relay on the market to stay positive. and I would still owe the same $64k in mortgage interest. so did I really get ahead?I feel like a guaranteed $64,000 savings by paying off your mortgage is a pretty good investment. Better than anything you're gonna do anytime soon. Other then playing high risk and high reward in the market. Thats the only way I see you making that kind of money. I'm not sure how accurate this is but I kind of picture it as inflation is 8.3%. You're mortgage is 4%+. Just a break even your investments need to be maken you 13%.

Ya that how it works as far as I understand. I was more talking about that a option if you lose your job.

I'm not 100% positive but I believe my IRA was averaging around 8% and was setup for aggressive growth. but most of what was gained over the last 5 years is all gone. so we better have a great comeback in order to make up the loss. it's a fairly new IRA as it was something I created by moving the funds from a profit sharing plan at another job into it. it's about 5 years old now. only has about $25k in it now but got up to the low 30s before the crash. so I think that was about $7k in 5 years from I think it was $22k when I opened it. that puts it about 8%All that is looking at the short term though. i can see doing that if you plan to retire, where inflation and fixed income and pulling from investments is something you have to live off of.

right now, you have plenty of time to "let it ride". your rate of pay has not changed, your house payment has not changed, your savings has not changed. cost of living may have gone up but your investments are not paying for that. your investments have changed but they wont be stuck there, they will come back. people would not invest in the stock market if there was not some kind of return made from it, the issue is its going to be long term to see it when done correctly. you cant look at the short term imho because it really has no effect on you. on average, the market is 10% earnings over 15-20 year span.

imho, right now is the time to buy stocks. buy low, sell high.

How have your investments trended over the last 5-10 years? 20 years? look at this trend and see how its been doing in the long run.

- Status

- Not open for further replies.